BOT approves budget request; ISU submits request to IBHE

IBHE visits campus for budget meetings

The goal of the external budget process is to acquire a state appropriation that supports the University's operations for the following fiscal year. The timeline below depicts an approximate schedule for the annual budget process as it relates to the state appropriation.

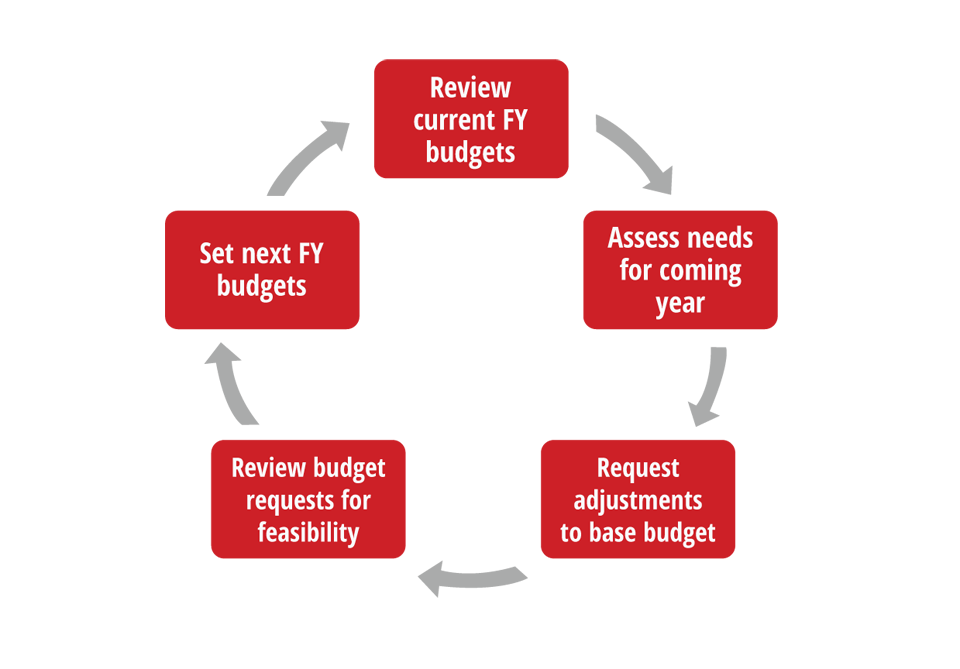

The annual internal budget process includes analyzing existing budgets and trends, assessing and planning for future needs, and setting opening budgets that align with the needs of the University for the coming fiscal year. The Budget Office works with fiscal managers to establish opening budgets according to expected expenditures. Each spring, fiscal managers set personnel and operating budgets for the upcoming fiscal year. The Board of Trustees considers the fiscal year internal budget at the October board meeting each year.

Budget Planning Process

Budgets for agency accounts are set during the annual budget process. The Budget Office has compiled tips and guidelines for setting agency budgets: